Hertfordshire County Council – Council Tax and budget information 2023/24

Council Tax bills

Over the coming year, we will spend more than £1billion delivering over 500 council services.

To enable this investment across Hertfordshire, councillors have agreed the council’s budget for

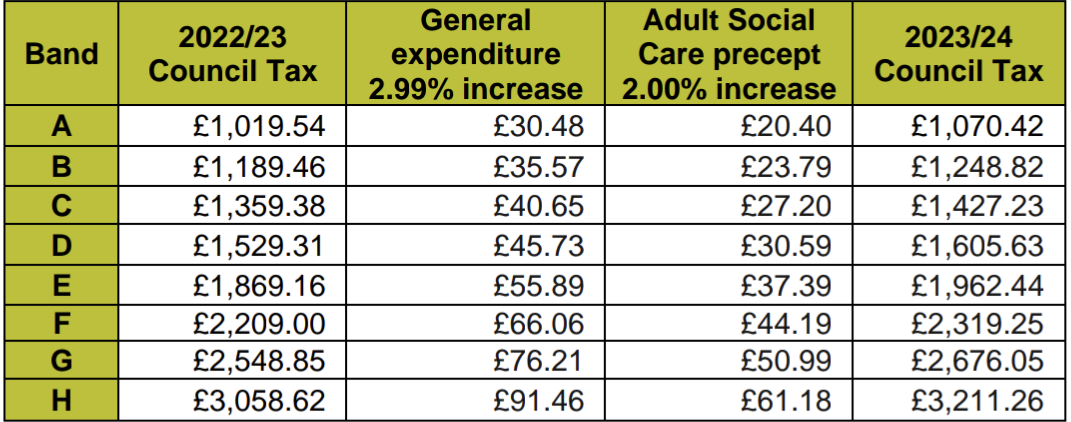

2023/24, which includes an increase of 2% for the adult social care precept and an additional 2.99% for general Council Tax. This works out at an extra £1.47 a week for average Band D households.

Council Tax is billed and collected by each district council on behalf of Hertfordshire County Council. The table below shows the county’s charge per band. The total amount of Council Tax you pay can be found on your bill.

Medium term financial position

While there is a balanced budget for 2023/24 and 2024/25, the council is still facing significant

financial challenges. These include continued inflationary pressures and uncertainty of future

government funding, along with increasing demands for services for children, adults, and the

elderly. As such, the medium-term outlook is extremely challenging.

The council will need to deliver savings rising from £27.4 million in 2023/24 to £78.4 million in

2026/27. These savings are in addition to those found already, which amounts to nearly £3.1

billion since 2010.

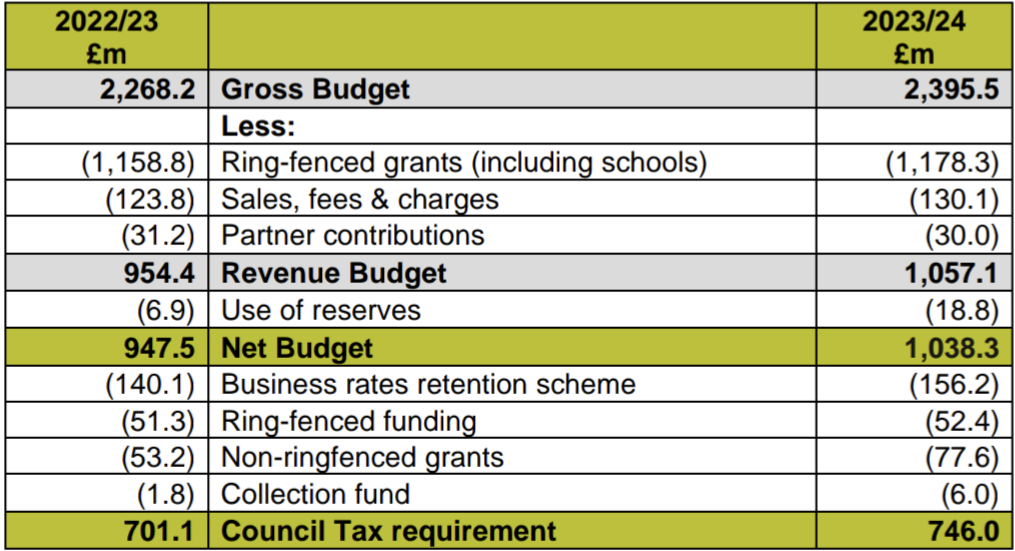

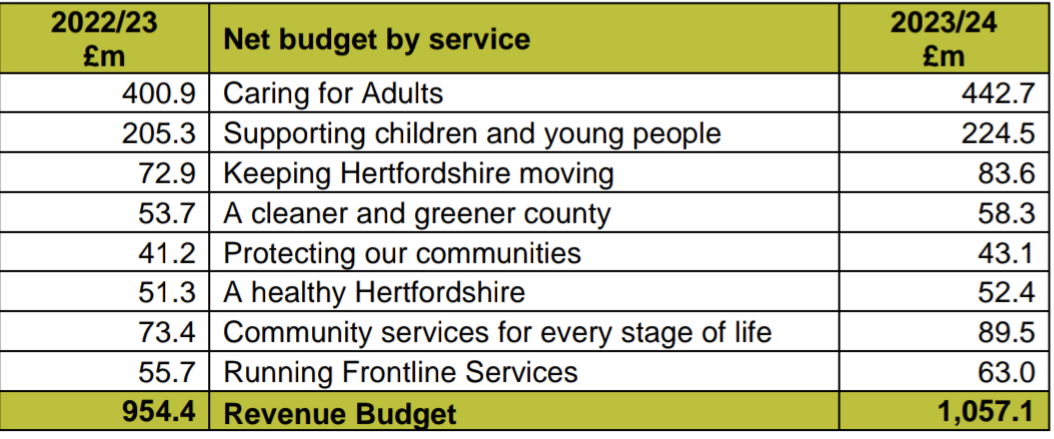

How spending has changed

In total we expect to spend a gross amount of £2,395.5m on all services compared with £2,268.2m in 2022/23. Towards this, we expect to receive £130.1m in sales, fees and charges for services and £1,178.3m in grants, of which £1,112.2m relates to the grants for schools. Allowing for this, the net budget will be £1,038.3m. This is an increase more than 10% from last year and reflects additional service demand, exceptional inflationary pressures, and new investment opportunities.

The Council Tax requirement has changed from £701.1m to £746.0m reflecting the 4.99%

increase in the amount charged and a 1.3% increase in the taxbase.

A message from Watford Mayor: The last year has been really difficult for many residents across Watford. The cost of living emergency has affected household budgets. It has had an impact on the council too, with the cost of services and projects increasing.

Given these financial difficulties, we need to prioritise what we can deliver over the next year.

That is why we have put these issues at the top of our agenda:

l Supporting residents through the cost of living emergency.

l Protecting frontline local services.

l Delivering on our promise to be a net zero carbon borough by 2030.

To help with the cost of living emergency, last year we set up 21 welcoming spaces. These are places where residents can be in a warm place without worrying about heating bills and spend time with others. We will continue to provide concessionary rates for services and a council tax reduction scheme for low income households.

I am pleased that we will also provide our great programme of free public events, ensuring that all residents of Watford can meet publicly and have fun with their friends and family, no matter what their financial situation.

Climate change is a real threat and we need to do our part to reduce our carbon emissions to protect our planet. However, our drive to reach net zero will also help us financially. Our investment in the Town Hall and Colosseum, which will make the buildings more energy efficient, will save taxpayers up to £300k per year in running costs.

Last year we were awarded 17 green flags for our parks – more than anywhere else in Hertfordshire. We were also proud when three of our fantastic parks were named in the top 10 in the country. I have promised to continue investment in our green spaces and this is just what we will do.

For example, at Woodside Playing Fields we will refurbish buildings that house the boxing club and the cricket club and will also build a “changing places” bathroom which will increase accessibility to the park for those with physical disabilities. At other parks we will be improving footpaths, creating new habitats for wildlife and installing

new water fountains.

This budget means that we can continue to deliver excellent services for every resident in Watford, support those in financial difficulty and protect our environment for future generations.

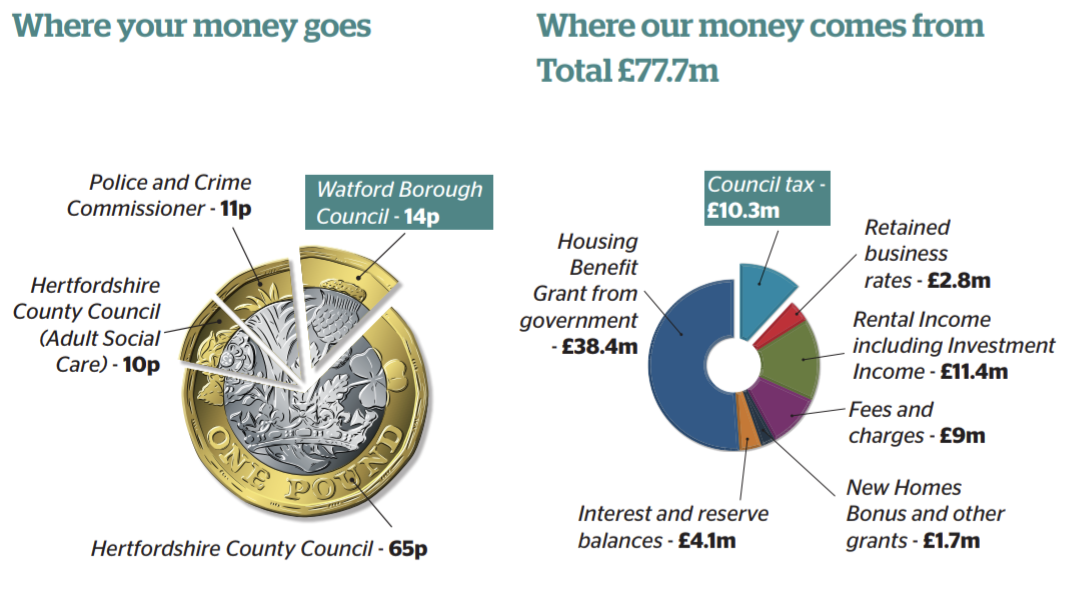

How much council tax will I pay?

The council tax you pay depends on the valuation band your property is in and the number of adults living in your home. Your council tax bill, which came with this leaflet, tells you which band you are in and the amount of tax you have to pay. The property band is determined by the Valuation Office Agency (VOA).

If you think that your council tax band is wrong, you can contact the VOA on 0300 0501 501 or visit voa.gov.uk.

You must be logged in to post a comment.