Autumn Statement 2022 contents unveiled in the House of Commons.

Jeremy Hunt who has been Chancellor of the Exchequer since 14 October 2022, has revealed tax rises and spending cuts aimed at mending the nation’s finances worth billions of pounds.

The Autumn Statement 2022 comes at a time of significant economic challenge for the UK and global economy. Growth is slowing and the International Monetary Fund (IMF) predicts a third of the global recession in the coming months.

This comes against a backdrop of higher levels of government debt due to the economic impacts of the COVID-19 pandemic and current energy crisis. Debt interest spending is now expected to reach a record £120.4 billion this year. These factors have contributed to a significant gap opening between the funds the government receives in revenue and its spending.

The government’s priorities are stability, growth and public services. And to achieve this aim, the government has reversed nearly all the measures in the Growth Plan 2022.

Taxation and Earnings

- UK national living wage for people over 23 to increase from £9.50 to £10.42 an hour from next April

- State pension payments and means-tested and disability benefits to increase in line with inflation by 10.1%

- The threshold at which workers start paying National Insurance contributions (NICs) was raised from £9,880 to £12,570, and in November the Health and Social Care Levy was reversed, saving almost 30 million workers an average of £480 in total in 2023-24.

- Reduces the top 45% additional tax income rate threshold from £150,000 to £125,140

- Income tax personal allowance and higher rate thresholds frozen for further two years, until April 2028

- Main National Insurance and inheritance tax thresholds also frozen for further two years, until April 2028

- Tax-free allowances for dividend and capital gains tax also due to be cut next year and in 2024

Energy

- Household Energy Price Guarantee (EPG) £2,500 cap extended for one year, with typical bills capped at £3,000 a year from April

- Households on means-tested benefits will get £900 support payments next year

- £300 payments to pensioner households, and £150 for individuals on disability benefit

- Windfall tax on profits of oil and gas firms increased from 25% to 35% and extended until March 2028

- New “temporary” 45% tax on companies that generate electricity, to apply from January

Putin’s illegal war in Ukraine has contributed to a surge in energy prices, driving high inflation across the world. Central banks have interest rates to get inflation under control, which pushed up the cost of borrowing for everyone.

The Economy

- The Office for Budget Responsibility judges UK to be in recession, meaning the economy has slowed for two quarters in a row

- It predicts growth for this year overall of 4.2%, but size of the economy will shrink by 1.4% in 2023

- Growth of 1.3%, 2.6%, and 2.7% in 2024, 2025 and 2026

- UK’s inflation rate predicted to be 9.1% this year and 7.4% next year

- Unemployment expected to rise from 3.6% to 4.9% in 2024

- Government will give itself five years to hit debt and spending targets, instead of three years currently

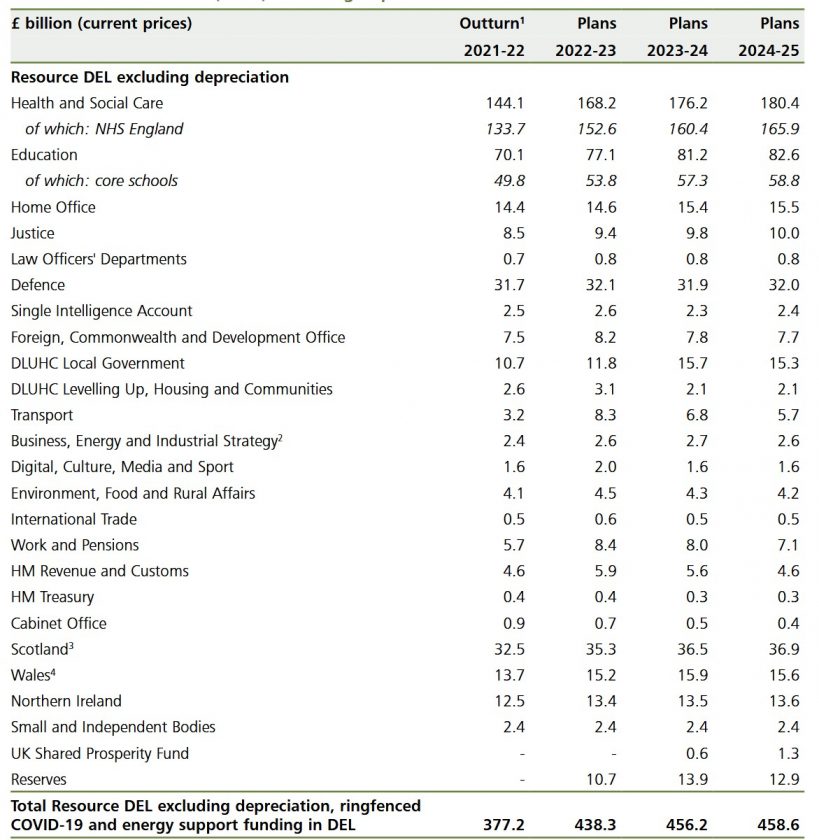

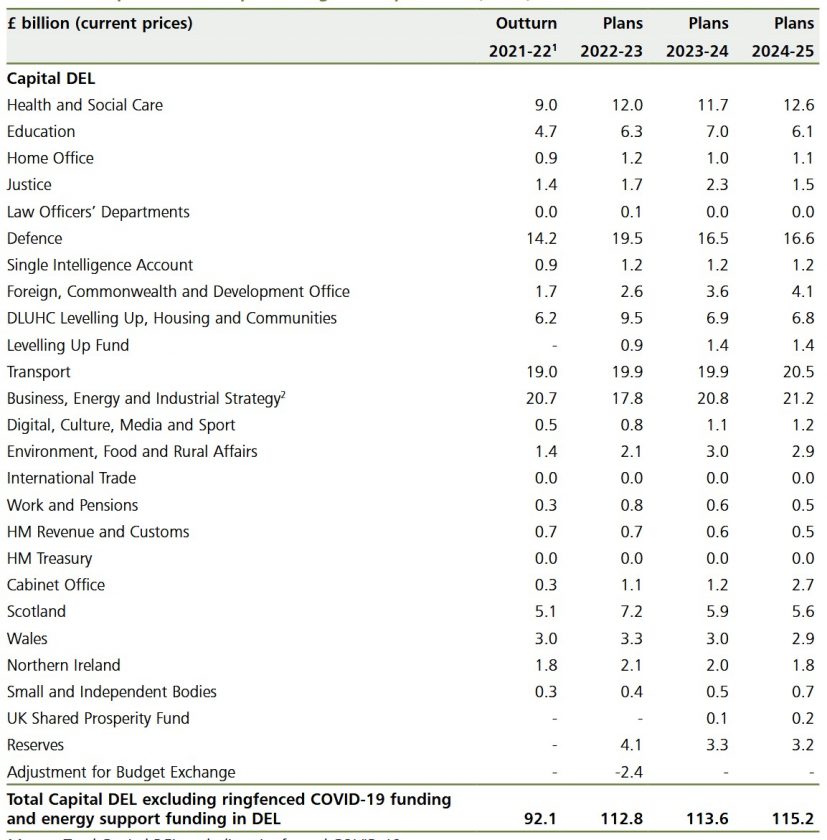

Government Spending

- Defence spending to be maintained at 2% of national income – a Nato target

- Overseas aid spending kept at 0.5% for the next five years, below the official 0.7% target

Up to £8 billion of funding available for the NHS and adult social care in England in 2024-25. This includes £3.3 billion to respond to the significant pressures facing the NHS, enabling rapid action to improve emergency, elective and primary care performance, and introducing reforms to support the workforce and improve performance across the health system over the longer term.

The core schools budget in England will receive £2.3 billion of additional funding in each of 2023-24 and 2024-25

Government Documents available in full here